The Humanoid Gold Rush: Why Robots Are About to Become Your Next Portfolio Obsession

How I Learned to Stop Worrying and Love Our Future Robot Overlords (Financially Speaking)

The Setup: Welcome to the Future, It's Expensive

Picture this: It's 2024, you're scrolling through LinkedIn (because apparently that's what we do now for entertainment), and suddenly everyone's talking about humanoid robots like they're the new Bitcoin. Except this time, instead of digital gold that nobody understands, we're talking about actual metal beings that can fold your laundry and potentially steal your job.

The difference? This time, the math actually makes sense.

Morgan Stanley just dropped a research bomb that should make every investor's robot-loving heart skip a beat: they're projecting a $5 trillion annual market by 2050 for humanoids. To put that in perspective, that's roughly double the current revenue of the 20 largest global auto companies combined. Yes, you read that right – robots are about to become bigger than cars.

The Numbers Game: Size Matters (And So Does Timing)

Let's talk turkey. MS estimates we'll have 1 billion humanoids wandering around by 2050, generating that eye-watering $5 trillion in annual sales. But here's where it gets interesting – and where most people will get the timing spectacularly wrong.

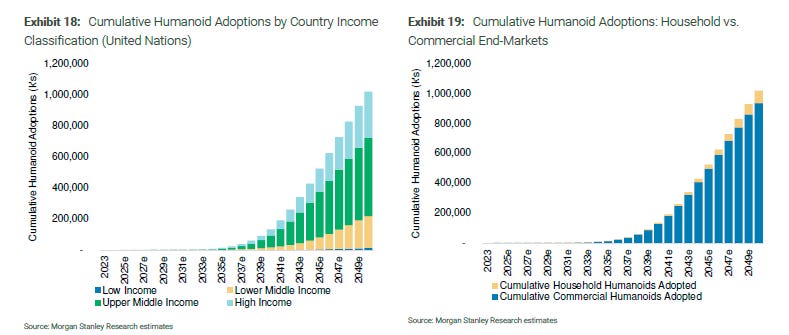

This isn't happening overnight. We're looking at just 24 million units by 2036, ramping to 134 million by 2040. The real hockey stick doesn't hit until the 2040s. So if you're expecting to retire next year on your humanoid ETF gains, you might want to adjust those expectations.

The geographic breakdown is fascinating and probably not what you'd expect. Nearly 50% of these robots will end up in upper middle-income countries (think China, Brazil, Mexico), with only 30% in high-income countries. This isn't just a rich person's toy – it's a global productivity play.

The Reality Check: B2B Before B2C (Sorry, Jetson Fans)

Here's where things get real. Forget your sci-fi fantasies of robot butlers serving you morning coffee. 92% of humanoids will be for industrial and commercial use. Only 80 million will make it into homes by 2050, and frankly, that might be optimistic.

Why? Three reasons that should surprise absolutely no one who's ever tried to explain Bitcoin to their parents:

Affordability: Global average income is ~$10k. Robot costs starting at $50-200k. Do the math.

Safety & Social Acceptance: Turns out people are weird about advanced AI hanging around their kids and pets. Who knew?

Technical Requirements: Home environments are messy, unpredictable chaos. Industrial settings? Much more structured.

The Value Chain: Where the Money Actually Lives

This is where it gets spicy for investors. Not all robot exposure is created equal, and the value chain breakdown tells a fascinating story about where the real money will be made.

The Brains: Consolidated and Profitable

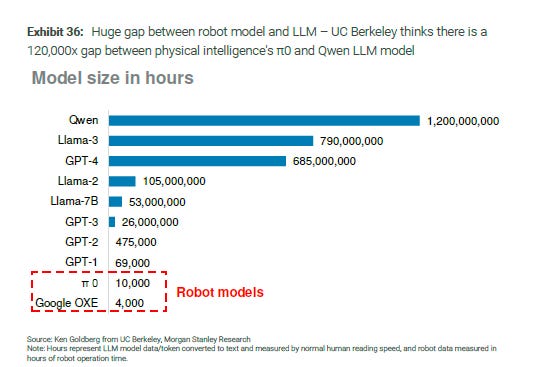

The robot model market (think ChatGPT but for physical actions) will be highly consolidated. Why? Because developing these systems requires massive scale, enormous datasets, and the kind of computing power that makes your gaming rig look like a calculator.

Current leaders include NVIDIA's ISAAC GR00T, Google's Gemini Robotics, and a handful of others. But here's the kicker – the data requirements are insane. We're talking about a 120,000x gap between current robot models and mature LLMs like ChatGPT.

The Bodies: It’s Complicated

The integrator market (companies building actual robots) will be fragmented, at least initially. There are already 80+ humanoid startups in China alone, and more popping up globally. Think early days of the auto industry, but with more venture capital and fewer mustaches.

But here's where it gets interesting for component suppliers:

High-Tech, High-Margin Winners:

6-axis force/torque sensors

Planetary roller screws

Harmonic reducers

These components have high technical barriers and significant market potential. Current suppliers are limited, and the China vs. non-China price gap is massive (often 3x+).

The Scalability Play:

Frameless torque motors

Coreless motors

Lower tech barriers but huge volume potential. Each humanoid needs multiple motors, creating a massive addressable market for companies that can achieve scale.

The China Factor: Love It or Hate It, You Can't Ignore It

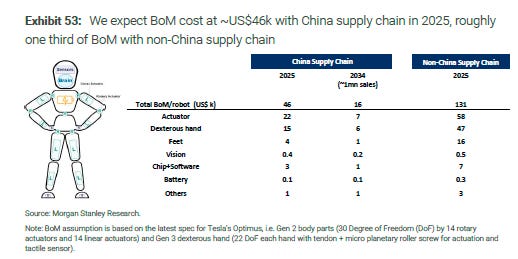

Here's something that'll make dinner conversations awkward: China's supply chain is absolutely critical for making humanoids affordable. Current BoM costs using Chinese suppliers are roughly one-third of global alternatives.

MS estimates a Chinese supply chain humanoid BoM at ~$46k in 2025, falling to $16k by 2034 when production hits 1 million units annually. The same robot using non-Chinese suppliers? $131k in 2025.

This creates an interesting geopolitical investment angle. US tariffs will likely push up domestic robot costs in the short term, but could also drive Chinese suppliers to build US capacity long-term (think auto suppliers operating in China). It's not necessarily anti-China policy, it's anti-offshoring policy.

The Timeline: Patience, Young Padawan

The adoption curve looks like this:

2025-2030: Education, research, early commercial pilots

2030-2035: Industrial applications scale up

2035-2040: Commercial services expand

2040-2050: Household adoption finally kicks in

This timeline matters for investors because it means we're still in the "building infrastructure" phase, not the "harvest profits" phase. The companies that survive and thrive will be those that can weather the development period and scale when adoption accelerates.

The Trade Ideas: Beyond the Obvious

The Obvious Plays:

Tesla (TSLA) - MS's top pick with $410 target

NVIDIA (NVDA) - The picks and shovels play

Major Chinese component suppliers

The Less Obvious But Potentially More Interesting:

1. The Chip Equipment Angle: Companies supplying manufacturing equipment for humanoid components. Think about the solar panel playbook – when China achieved equipment localization, cost reductions accelerated dramatically.

2. The Materials Play: Rare earth magnets, specialty alloys, advanced ceramics. These are the "boring" inputs that become critical bottlenecks. Tesla's CEO already mentioned Chinese restrictions on permanent magnet exports affecting Optimus development.

3. The Training Data Companies: Somebody has to generate the massive datasets needed to train these robots. Companies with large-scale simulation capabilities or real-world data collection could be hugely valuable.

4. The Insurance/Liability Angle: When millions of robots start working alongside humans, someone's going to need to insure that risk. Could be interesting for specialty insurers.

5. The Contrarian Geographic Play: While everyone focuses on US and China, the real volume might be in "upper middle income" countries. Companies with strong distribution in Brazil, Mexico, Indonesia could be dark horses.

Risk Factors (Or: Why This Could All Go Spectacularly Wrong)

The AI Winter Returns: If LLM progress stalls, robot capabilities plateau

Regulatory Backlash: Governments decide robots are job-killers and tax/restrict them heavily

The Uncanny Valley: Consumers never get comfortable with humanoid robots

Technical Limits: Physics turns out to be harder than Silicon Valley thinks

Economic Reality: A global recession kills corporate capex for "nice to have" robots

The Bottom Line: It's Real, But It's Not Tomorrow

The humanoid opportunity is massive and probably real. But it's also further out than the hype suggests, more concentrated in B2B applications than sci-fi fantasies, and heavily dependent on continued AI progress and cost reduction.

For investors, this means:

Play the infrastructure build-out (components, chips, software tools)

Avoid timing the adoption curve (it'll be lumpier than you think)

Geographic diversification matters (it's not just a US/China story)

Technical barriers create moats (high-end components should stay profitable)

The companies that win will be those that can survive the development phase, achieve scale when adoption accelerates, and maintain technical differentiation in an increasingly commoditized market.

In other words, it's a typical next-big-thing investment theme: massive opportunity, tricky timing, and most participants will lose money. But the winners will win big.

Just make sure you're positioned for the 2040s party, not the 2025 hangover.

Disclaimer: This analysis incorporates data and projections from Morgan Stanley Research but represents our own interpretation and investment opinions. Past performance doesn't predict future results, robots might achieve consciousness and decide financial markets are stupid, and as always, don't invest money you can't afford to lose in the robot apocalypse. The author may or may not own positions in mentioned securities and definitely owns too many sci-fi movies. This is not personalized investment advice, consult your financial advisor before making investment decisions, and remember that all projections are essentially sophisticated guesses about an uncertain future involving robots.