Metinvest: A Steel(ing) Question on Whether Bonds Are Worth the Risk

When Ukrainian sovereign debt and corporate debt offer similar yields, who wins? (Spoiler: It's not the corporate bond investors)

Metinvest: A Steel(ing) Question on Whether Bonds Are Worth the Risk

When Ukrainian sovereign debt and corporate debt offer similar yields, who wins? (Spoiler: It's not the corporate bond investors)

The TL;DR

Remember when people said "there's no such thing as a free lunch"? Well, there's also no such thing as free yield. Metinvest bonds are yielding around 17%, which sounds great until you realize Ukrainian sovereign debt yields basically the same thing (17.3%). So you're taking all the war risk, PLUS company-specific risk, PLUS some specific weird operational risks (hello, Pokrovske Coal mine situation), and getting paid basically nothing extra for it. That's like ordering both the regular and spicy wings at Buffalo Wild Wings and paying double for the same heat level.

The bonds are priced at ~80-90 cents on the dollar, depending on maturity, which tells you the market is already pricing in significant operational disruption. The thing is, they might be pricing in even more of that disruption now.

The Full Story: When Corporate Bonds Become a Proxy for "Also War, But With Extra Steps"

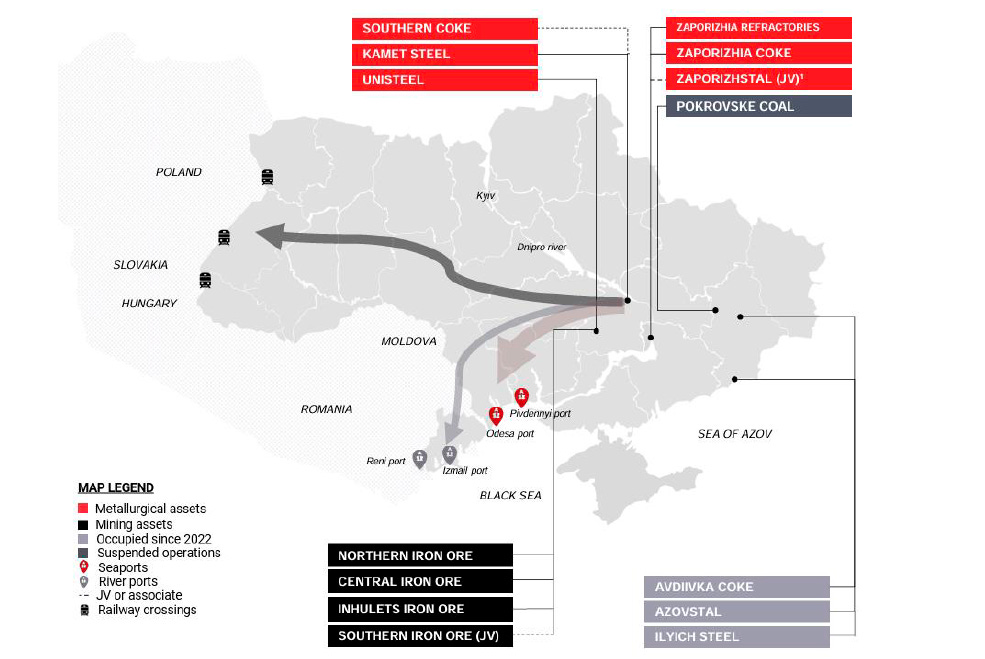

Metinvest is one of those companies that comes with a built-in stress test: they operate in an active war zone. Founded in 2006, they're an international, vertically integrated mining and metals company that manages the complete production chain, from iron ore to steel products. Think ArcelorMittal, but with way more drama.

The Financial Picture (When Numbers Tell Stories)

Let's start with the good news first (there's not much of it, so let's enjoy it):

EBITDA: $957m in 2024 (up 11% year-over-year)

Cash position: $657m (up 2% from 2023)

Leverage: Net debt/EBITDA of 1.1x (down from 1.6x)

Revenue: $8.1bn (up 9% y/y)

Looks pretty decent on paper, right? Here's where it gets interesting...

The Pokrovske Problem: When Your Coal Mine Becomes a Geopolitical Flashpoint

This is where things get spicy. Pokrovske Coal, which made up about 40% of Metinvest's EBITDA (approximately $361m), has had to suspend operations because, well, there's a war happening literally at their doorstep. Russian forces are now 1-2.5km away from the mine.

To put this in perspective: if Pokrovske completely stops producing, here's what happens:

EBITDA drops from $957m to $596m

Net leverage jumps from 1.1x to 2.2x

The company still survives, but barely

Metinvest has essentially two scenarios in their playbook:

External sales loss: About 15% EBITDA hit (leverage goes to 1.5x) - manageable

Complete loss of the asset: 40% EBITDA hit (leverage hits 2.2x) - approaching critical

The kicker? Bond prices (especially the 2029s trading at ~65 cents) already seem to be pricing in significant Pokrovske risk. So the market knows, but is it pricing it fully? That's the trillion hryvnia question.

The Iron Ore Silver Lining

Here's the one bright spot: Iron ore operations are actually doing pretty well. Capacity utilization improved to ~50% of pre-war levels (up 15 percentage points year-over-year). This partially offsets the Pokrovske challenges, but it's like having one flat tire fixed while the other three are slowly deflating.

The Math That Makes You Go "Hmm"

Let's do some napkin math (I'm writing this on a physical napkin, obviously):

Metinvest current net leverage: 1.1x

Current yield on 2026 bonds: ~17%

Ukrainian sovereign bonds: 17.3%

Yield difference: You're getting paid 0.3% for taking on ALL the company-specific risks

Compare this to MHP (another Ukrainian company):

Net leverage: 2.2x (worse!)

2026 bond yield: only 11.9%

So MHP, with WORSE leverage, pays less yield. Why? Because the market thinks their chicken business is less risky than Metinvest's coal-and-steel business. And they're probably right.

Vodafone Ukraine: The Cherry on This Debt Sundae

Even Vodafone Ukraine bonds yield only ~10% compared to Metinvest's 17%. Apparently, the market thinks running a telecom network in a war zone is less risky than running mines and steel plants. Again, probably right.

The Steel Market Context (Because Everything Connects)

The broader steel market is actually looking up for 2025:

Expected demand growth of 1.2% year-over-year

Prices potentially hitting $850-$900/tonne in Q3 2025 due to tariffs

Strong demand for OCTG (Oil Country Tubular Goods) thanks to U.S. policy changes

Agricultural sector recovering (tractor-trailer orders up)

But here's the thing: Metinvest can only benefit from this upside if they can actually produce and sell steel. Which requires, you know, access to coal and iron ore. And current geopolitical situations suggest that's not a given.

The Currency Cushion

One small positive: 86% of Metinvest's sales are in hard currencies (USD, EUR, GBP), providing a natural hedge against hryvnia depreciation. But this is like having a good umbrella in a hurricane - it helps, but only so much.

Historical Performance: The "Before Times"

Looking at historical numbers (because who doesn't love nostalgia?):

2021 EBITDA: $6.0bn

2022 EBITDA: $1.8bn (war year)

2023 EBITDA: $0.9bn

2024 EBITDA: $1.0bn

The company has demonstrated resilience, managing to generate positive cash flow even when EBITDA was cut by 85%. That's impressive. But as they say in aviation safety: past performance is no guarantee of future results, especially when missiles are involved.

The Trading Comps: A Reality Check

Comparing to peer companies:

ArcelorMittal trading at 4.0x EV/EBITDA

US Steel trading at 8.6x EV/EBITDA

Metinvest trading at... well, probably closer to 1.5x if you account for Pokrovske losses

The valuation screams "distressed." The yield suggests "extremely distressed." The operating environment whispers "maybe don't invest your retirement savings here."

The Bottom Line

Here's the reality: You're not getting paid nearly enough to take these risks. The yield differential between Metinvest bonds and Ukrainian sovereign debt is practically rounding error. You're basically volunteering to take on company-specific risks for free.

If you want Ukrainian exposure (and Lord knows why you would in this environment), just buy the sovereign bonds. Same country risk, same war risk, no Pokrovske risk, no coal mine risk, no leverage concerns, no operational issues.

The 2029 bonds trading at ~81 cents might offer slightly better relative value versus the 2026s (~75-78), but that's like choosing between two different flavors of ice cream on the Titanic.

In finance speak: the risk-adjusted return is unfavorable. In human speak: these bonds are like ordering extra spicy buffalo wings and paying premium price, but only getting medium spice. You're taking all the pain with none of the extra gains.

My recommendation? Watch from the sidelines. If Metinvest actually solves their operational challenges, maybe their spreads widen enough to compensate for the risks. But right now? This is what finance people call "negative convexity" and what normal people call "a sucker's bet."

Disclaimer: This is not investment advice. It's entertainment, with some finance sprinkled on top. If you're actually considering these bonds, please consult a licensed financial advisor who spent more than 20 minutes reading about this company. Also, I'm not Matt Levine, just borrowing his style because it's more fun than writing like a compliance manual.