Leonardo SpA: When Defense Spending Goes Brrrr (And Other Italian Delights)

Or: How I Learned to Stop Worrying and Love the Military-Industrial Complex

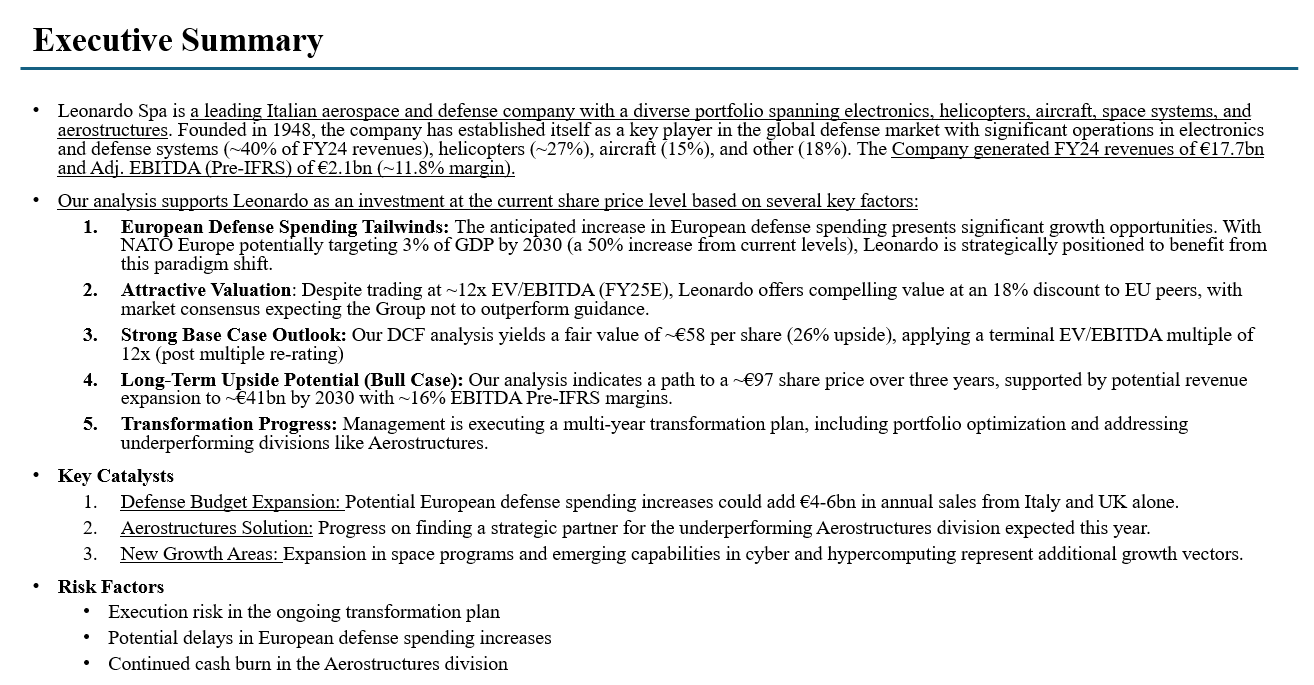

Picture this: You're sitting in a room with every Italian stereotype—a pasta maker, a Ferrari engineer, and a defense contractor. The pasta maker talks about "al dente perfection," the Ferrari guy waxes poetic about "la dolce vita," and the defense contractor? He pulls out a spreadsheet showing how NATO's 3% GDP target could make shareholders richer than a Medici. Welcome to Leonardo SpA, where the real Renaissance is happening in the balance sheet.

The Thesis: European Rearmament Meets Italian Efficiency (Yes, Really)

Here's what's keeping Leonardo's management up at night (in a good way): Europe is finally waking up to the fact that Putin's not exactly the neighborly type who borrows sugar. The result? NATO's shifting from "we should maybe spend more on defense" to "DEFCON 1: Open the checkbook."

Current state: Italy spends 1.5% of GDP on defense

Where it's headed: 3% by 2030 (that's a casual 100% increase)

What this means for Leonardo: Cha-ching to the tune of €4-6b additional revenue

Morgan Stanley's base case shows Leonardo hitting €60/share (up 26.2% from current). The bull case? A cool €97 (+111%). That's not a typo—we're talking about potentially doubling your money faster than you can say "gabagool."

But wait, there's more. The Industrial Plan Update just dropped like a mixtape, and it's got more beats than a helicopter rotor. Management's guidance: €24b in revenue by 2029, with EBITDA margins expanding faster than a military budget in wartime.

The Multi-Trick Pony: More Divisions Than Italy Has Prime Ministers

Leonardo isn't your average defense play. This thing's got more moving parts than a Leonardo da Vinci sketch:

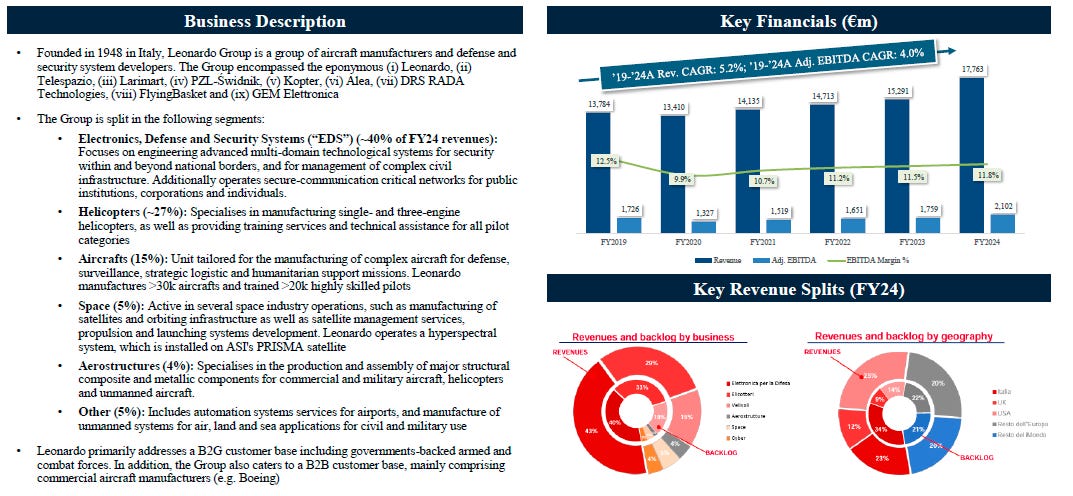

Defense Electronics (40% of revenue): The Money Printer

This is where the magic happens. 14.2% margins today, targeting 18% by FY29. That's not just growth; that's what happens when governments suddenly realize they need more toys to play with. The order book's thicker than a phonebook in 1980.

Key wins upcoming:

Tempest fighter program development

European FCAS integration contracts

Whatever cyber warfare contracts make lawyers nervous

Helicopters (27%): Still Flying High

While everyone's worried about autonomous drones, Leonardo's helicopter division keeps churning out profits like an Italian nonna makes pasta. 9.3% margins that could realistically hit 10%+ as production scales.

Fun fact: They're delivering 210 helicopters by 2027. That's enough to evacuate entire boardrooms when quarterly earnings disappoint.

Aircraft (15%): The Sleeping Giant

Currently at 12% margins but with upside potential that would make a SPAC pitch deck blush. The commercial cycle's turning, and guess who's perfectly positioned?

Aerostructures (4%): The Problem Child Everyone Loves to Hate

Ah, Aerostructures. The division that's bled more red ink than a horror movie set. Currently sporting a -16.6% margin (yes, negative), it's the anchor dragging down an otherwise pristine growth story.

The kicker: Management claims they're in "advanced discussions" for a strategic partnership. Translation: "We're trying to gift-wrap this dumpster fire before anyone notices."

Space (5%): The Final Frontier

Small but growing, with margins expanding from 5% to 8%. Because when Earth's wars aren't enough, there's always outer space.

The Italy Factor: When Being Italian Is Actually Good for Business

Here's something that'll blow your mind: Being Italy's defense champion might actually be a feature, not a bug. As NATO pressure mounts, who do you think gets first dibs on all those juicy Italian contracts? Hint: It's not BAE Systems or Lockheed Martin.

The math is beautiful:

Italy needs to double defense spending

Leonardo has ~18% market share domestically

National champion status = pricing power

Pricing power = margin expansion dreams that would make Warren Buffett weep

The backlog tells the story: €44.2b, up 7.8% YoY. That's enough visibility to make a three-year-old with ADHD jealous.

The Morgan Stanley Playbook: Valuation That Makes MBA Professors Cry

Morgan Stanley's throwing around multiples like a drunk sailor with daddy's credit card:

New multiples:

Helicopters: 13x EV/EBIT (from 11x)

Defense Electronics: 20x EV/EBIT (from 13x)

Aircraft: 14x EV/EBIT (from 11x)

The implied group multiple? 16x EV/EBIT by 2027. That's premium-to-peers territory, baby. And before you scream "overvaluation," remember: premiums aren't handed out like participation trophies. You pay up for growth, transformation, and the sweet, sweet tailwinds of geopolitical anxiety.

The DCF circus:

Base case: 7.5% WACC, 2.5% terminal growth

Fair value: €61

Current price: €45.9

Upside: Math says 32%, but who's counting?

The Bear Case: When Reality Bites Back

Now, let's pour some cold espresso on this party:

1. Aerostructures: The Gift That Keeps on Taking

If the strategic partnership falls through faster than a Tinder date, we're looking at continued cash burn. Current burn rate: enough to make crypto investors feel better about their life choices.

2. EU Defense Spending: Political Will vs. Political Reality

Sure, everyone says they'll spend more on defense. But between saying and doing lies a graveyard of fiscal promises. Remember the 2% target? We're still working on that.

3. Execution Risk: Theory vs. Practice

Transforming a conglomerate is harder than explaining cryptocurrency to your grandparents. The margin expansion targets are aggressive enough to make a politician blush.

4. Key Man Risk

Current CEO and Co-GM are doing the heavy lifting. What happens if they decide to retire to a Tuscan villa? Succession planning in Italian companies can be... entertaining.

The Technical Deep Dive: Reading the Revenue Runes

Let's get nerdy with the growth projections:

FY24A to FY29E Revenue CAGR:

Base case: 5.9%

MS Bull case: 7.0%

Downside case: 4.1%

But here's the kicker: Equipment spending in EU could surge 140-240% by 2030. Leonardo's exposed to this through ~68% of revenues tied to equipment. That's not just tailwinds; that's hurricane-force profits.

The Fund Positioning: Contrarian Paradise

Here's your edge: While 67% of analysts say "Overweight," institutional ownership is lower than expected. The stock's trading at a 7% discount to the sector despite having cleaner fundamentals than most peers.

The positioning sweet spot:

Retail is underweight (they always are)

Hedge funds are cautiously optimistic

Morgan Stanley's turning bullish right before earnings season

The Catalyst Roadmap: What to Watch

Near-term catalysts:

Q1 2025 results: Order momentum confirmation

H1 2025: Aerostructures partnership announcement

Q3 2025: Italian defense budget reveal

Medium-term catalysts:

NATO Summit June 2025: 3% GDP spending confirmation

Eurosatory Defense Exhibition: New contract wins

Capital Markets Day 2025: Updated targets

The Options Play: For the Degenerates Among Us

Current options imply a 40.2% chance of the stock hitting €39 (downside case) and a 15.4% chance of hitting €60. If you believe the thesis, the risk/reward is asymmetric enough to make Kelly criterion fans salivate.

The smart money move:

Sell puts at €42 support

Buy calls around €50-52

Or just buy shares because we're not your financial advisor

The Competitive Landscape: David Among Goliaths

Leonardo trades at ~12x FY25E EV/EBITDA while peers like Rheinmetall command 18x. Is this a discount for being Italian, or an opportunity for multiple expansion?

Peer comparison madness:

Rheinmetall: Growing faster but paying for it

BAE Systems: Solid but boring

Airbus: Diversified but complex

Leonardo: Pure defense play with upside optionality

The Macro Overlay: When De-Dollarization Meets De-Militarization

Here's the bigger picture: As Europe re-arms, it's also trying to build sovereign defense capabilities. Leonardo's positioned as a bridge between Italian demand, European integration, and transatlantic cooperation.

The geopolitical arbitrage:

US pivot to Pacific

Europe forced to self-defend

Defense industrial base consolidation

Leonardo positioned at the intersection

The ESG Angle: Defense Gets Defensive

Before you scream "blood money," consider this: Defense spending is the ultimate ESG play. It's literally about Security (the S in ESG). Plus, Leonardo's transformation plan includes:

50% reduction in CO2 emissions by 2030 (thanks, Greta)

Increased diversity in leadership (from binary to ternary?)

Governance improvements (not sure what that means, maybe more italians?)

The Bottom Line: Buy the Cannoli, Er, I Mean the Call

Leonardo's setting up what could be the trade of the European defense sector. The thesis is simple: structural increase in defense spending + portfolio optimization + Italian national champion status = 💰💰💰

My take: This isn't about whether defense spending will increase—it's about how much and how fast. Leonardo's positioned like a surfer who sees the wave building. The smart money? Already paddling out.

The Morgan Stanley Price Target: €60 (Base), €97 (Bull)

Current Price: €45.9

My Call: If you're not at least watching this stock, you're bringing a peace treaty to a defense spending fight.

The Final Word: Renaissance Men Make Renaissance Returns

In a world where everyone's looking for the next tech unicorn, Leonardo offers something better: a boring old defense company positioned for extraordinary growth. While Silicon Valley chases dreams, Leonardo builds the machines that protect them.

Investment checklist:

✅ Secular tailwinds

✅ Margin expansion story

✅ Strong order book

✅ Catalyst-rich environment

✅ Management executing transformation

⚠️ Aerostructures risk (manageable)

⚠️ Italian political risk (priced in?)

TL;DR for the ADD Traders

Three-slide elevator pitch:

Europe's defense spending is going parabolic

Leonardo owns that wave with national champion status

Stock's cheap for the growth it's about to deliver

Position sizing:

Risk tolerance: High

Time horizon: 12-18 months

Expected volatility: "Italian" (technical term)

Potential return: +100% (bull case)

Technical Analysis for the Chart-Watching Crowd

Support levels: €42, €40

Resistance levels: €50, €58

200-day MA: Trending up like defense budgets

RSI: Overbought? No, just getting started

The chart pattern: Cup and handle meets renaissance smile. In technical terms: "bullish AF."

The Whisper Number Game

Here's what the sell-side won't tell you: If Leonardo nails the Aerostructures fix AND locks in a major defense contract this quarter, we're looking at earnings revisions that could gap the stock 15-20% overnight.

Consensus EPS: €2.04 (FY26E)

My whisper number: €2.20+ if everything clicks

Bear whisper: €1.85 if Murphy's Law applies

Risk Management: Because YOLO Isn't a Strategy

Position limits:

Max 5% portfolio allocation

Stop loss at €41

Take profits at €65 (Base Case +40%)

Hold for €85+ (Bull Case breakout)

Hedging options:

Short DAX for market exposure

Long other Euro defense names for sector hedge

Keep cash reserves for averaging down

The Insider's View: Reading Between the Lines

Management's language is getting spicier. From "cautiously optimistic" to "confidence in achieving targets"—that's Italian for "we know something you don't."

CEO speak translation:

"Transformation on track" = We're killing it

"Market conditions supportive" = Money printer go brrr

"Strategic optionality" = We're shopping Aerostructures

"Committed to deleveraging" = Banks love us again

Conclusion: The Renaissance Awaits

In a market obsessed with software margins and recurring revenue, Leonardo offers something refreshingly old-school: real manufacturing, real contracts, and real government backing. It's Value investing meets Growth potential, wrapped in an Italian package that's about to unwrap itself.

The investment case:

Buy because NATO's scared

Hold because Italy's committed

Sell when... well, when's the next war ending?

Disclosure: The author may or may not have visited Italy, developed a taste for Chianti, and now exclusively trades in defense stocks while listening to Pavarotti. Past performance is no guarantee of future results, but a good espresso definitely helps with morning trade decisions.

The views expressed herein are those of a caffeine-fueled analyst who may or may not have watched The Godfather while writing this. Past performance is no guarantee of future results, but a good pasta sauce recipe usually is. If you've read this far, you deserve an Aperol Spritz. Salute!